how to claim new mexico solar tax credit

Returning ProSeries Professional and ProSeries Basic customers. Whats new in ProSeries Tax 2021.

How The Solar Tax Credit Makes Renewable Energy Affordable

The solar investment tax credit ITC or federal solar tax credit has been one of the most successful incentives in spurring the growth of solar energy in the US.

. Aimed to offset the initial cost of solar it allows you to deduct 26 of the total cost of your solar project from the federal taxes you owe. Waterproof IP65 and Heatproof outdoor security night light for wall patio garden porch lawn pathway gutter etc. 2W Monocrystalline silicon.

The Solar Market Development Tax Credit provides a tax credit of 10 for small solar systems including on-grid and off-grid PV systems and solar thermal systems. Go to the Help menu in your tax year 2020 software and select Download. The Qualified Plug-in Electric Drive Motor Vehicle Tax Credit is the main federal incentive program for electric cars available in the United States.

Here are the ones most commonly used by homeowners to reduce their solar panel costs and shorten their solar payback period. You can print other New York tax forms here. Weve been hard at work making Intuit ProSeries Tax even easier to use so you can save time on every return.

However solar roof tiles and shingles are not typically an option when leasing solar panels or in a power purchase agreement PPA. Through 2022 the solar tax credit is good for 26 of the system costs. In 2023 the credit goes down to 22 and you likely wont be able.

2021 Tax Credit. Under this program the purchase of a new electric vehicle is eligibe for a tax credit worth 7500 as long as it meets the following criteria. 5 Conversion Rate with 1.

Claim for College Tuition Credit or Itemized Deduction. Federal incentives for electric vehicles. An applicant claiming a state tax credit shall not claim a state tax credit pursuant to another law for costs related to the same solar energy system costs.

When the amount spent on the solar PV system is mostly used for residential rather than business purposes the residential credit may be claimed in full without. Can reduce your electricity bills and qualify for the Solar Investment Tax Credit ITC. These related forms may also be needed with the New York Form 201-I.

TaxFormFinder has an additional 271 New York income tax forms that you may need plus all federal income tax forms. High Efficient Solar Panel Our solar Panel is energy saving and with PET laminated solar panel and LED lights which is up to 20. Related New York Individual Income Tax Forms.

Yes but if the residence where you install a solar PV system serves multiple purposes eg you have a home office or your business is located in the same building claiming the tax credit can be more complicated. Nonresident Real Property Estimated Income Tax Payment Form. Solar shingles can also be eligible for state solar incentives net metering and renewable energy credits RECs.

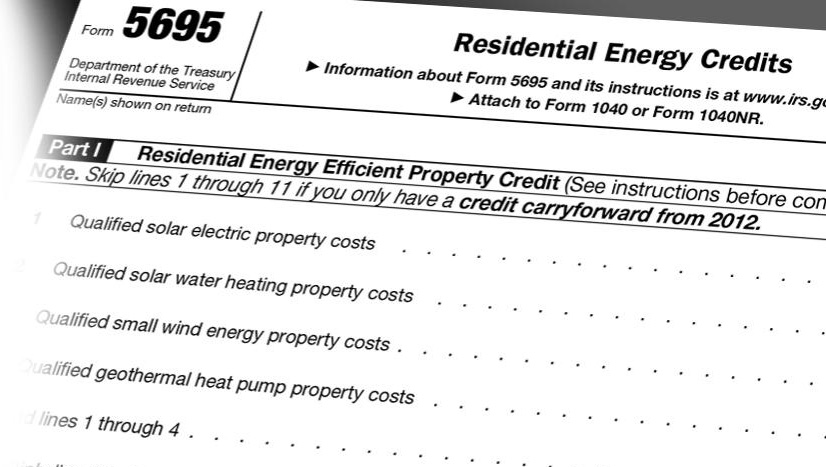

For full details on each new feature click here. The federal solar tax credit also known as the solar investment tax credit or ITC offers new solar owners in the United States a tax credit equal to 26 of costs they paid for their solar installation. Claim for Solar Energy System Equipment Credit.

Federal Solar Tax Credit A Homeowner S Guide 2022 Updated

What Is The Federal Solar Investment Tax Credit Itc Bluesel Home Solar

Federal Solar Tax Credit Guide Atlantic Key Energy

New Mexico Solar Incentives Rebates And Tax Credits

Sustainable Building Tax Credit Sbtc Energy Conservation And Management

Tax Credit Info Daylighting Systems Solar Powered Fans Solatube

Federal Solar Tax Credit A Homeowner S Guide 2022 Updated

Solar Tax Credit What If Your Tax Liability Is Too Small Palmetto

Residential Energy Storage Grows 9x In Q1 2018 Pv Magazine Usa Energy Storage Residential Storage

Can I Claim The Federal Solar Tax Credit For Roof Replacement Costs Westfall Roofing Tampa Sarasota

Solar Tax Credit 2022 Incentives For Solar Panel Installations

Easy Solar Tax Credit Calculator 2021

Pricing Incentives Guide To Solar Panels In New Mexico Forbes Home

.png)

Federal Solar Incentives New Mexico Solar Company

Brief History Of The Solar Investment Tax Credit Itc Allterra Solar

What Are The New Mexico Solar Tax Credits

Federal Solar Tax Credit Northern Arizona Wind Sun

New Mexico Energy Tax Credit Rebates Grants For Solar Wind And Geothermal Dasolar Com